Table of Content

- IRS Audit: Understanding the basics

- Statute of Limitations

- Audits Involving Foreign Income or Assets

-

IRS Audit Process

- Why has the IRS chosen to audit my tax return

- How will I be informed if I am selected for an audit

- How does the IRS conduct its audits

- What documents and information do I need to provide during an audit

- How can I confirm that the IRS has received my response during an audit

- Can I ask for an extension to respond to the IRS audit

- How long does the IRS audit process usually take

- What rights do I have during an audit by the IRS

- How does the IRS conclude at the end of an audit

- What happens if I agree with the findings of the IRS audit

- What happens if I disagree with the findings of the IRS audit

The IRS audit: How far back can they audit you?

Have you ever wondered how far back the IRS can go when auditing your tax returns? It's a question that many taxpayers like you ask, and the answer can be complicated. Understanding the rules for IRS audits and the statute of limitations can help you stay compliant and avoid potential penalties.

In this blog, we'll explore how far back the IRS can audit you and any exceptions or special cases that may apply. Whether you're a business owner, self-employed individual, or wage earner, knowing your rights and responsibilities regarding tax audits is essential. So let's dive in to learn more about this important topic.

IRS Audit: Understanding the basics

An IRS audit is an examination of a taxpayer's financial and tax-related information by the Internal Revenue Service (IRS) to ensure that the taxpayer is in compliance with tax laws and regulations. The audit may be conducted through mail, in-person meetings, or a combination of both. If the IRS identifies any errors or discrepancies, they may assess additional taxes, interest, and penalties.

You need to understand the fundamentals of IRS auditing, such as the statute of limitations, foreign income or asset audit, and the entire auditing process to find out how far back the IRS can audit you:

Statute of Limitations:

For Federal:

Regarding the IRS audit process, you must understand the Statute of Limitations for Tax Audits. For tax audits, the statute of limitations is generally three years from the filing deadline or the date the your return was filed, whichever comes later. This means the IRS has three years to audit your returns before assessing additional taxes or initiating an audit unless certain exceptions apply.

Exceptions that extend the statute of limitations include unfiled returns, fraud, and substantial understatement of income. The statute of limitations is extended indefinitely if you fail to file a return or files a fraudulent return. Furthermore, if you understate your income significantly, the statute of limitations is increased to six years. You must understand these rules and exceptions to remain compliant and avoid potential penalties or fines.

For States:

State tax audits are subject to a statute of limitations, limiting the time the state can audit a taxpayer's returns. Tax audit statute limitations vary by state and may differ from federal statutes. For example, California has a four-year statute of limitations for state tax audits, whereas Texas has a two-year statute of limitations for state tax audits. To remain compliant with state tax laws and avoid any potential penalties or fines, you should be aware of the specific state statutes of limitations for tax audits in their state and understand how they differ from federal statutes.

Audits Involving Foreign Income or Assets:

The audit rules involving foreign income or assets can be complex and stringent. If you fail to report income of more than $5000 from foreign assets or investments, the IRS can audit you for up to six years after you file your tax return. If the IRS suspects you of failing to report a significant amount of foreign income, they can go back even further. In addition to general rules, there are specific rules for foreign bank accounts and other financial assets, such as the Foreign Account Tax Compliance Act (FATCA).

FATCA is a federal law enacted to prevent U.S. taxpayers from evading taxes by hiding income and assets in offshore accounts. It requires foreign financial institutions to report certain information about their U.S. account holders to the IRS. This information includes the account holder's name, address, account number, and the amount of money in the account. The IRS can audit you indefinitely if you fail to file certain tax forms. Form 5471 is required if you own a portion of a foreign corporation, Form 3520 is required for your gifts or inheritance from foreign nationals over $100,000, and Form 8938 is required for your overseas assets.

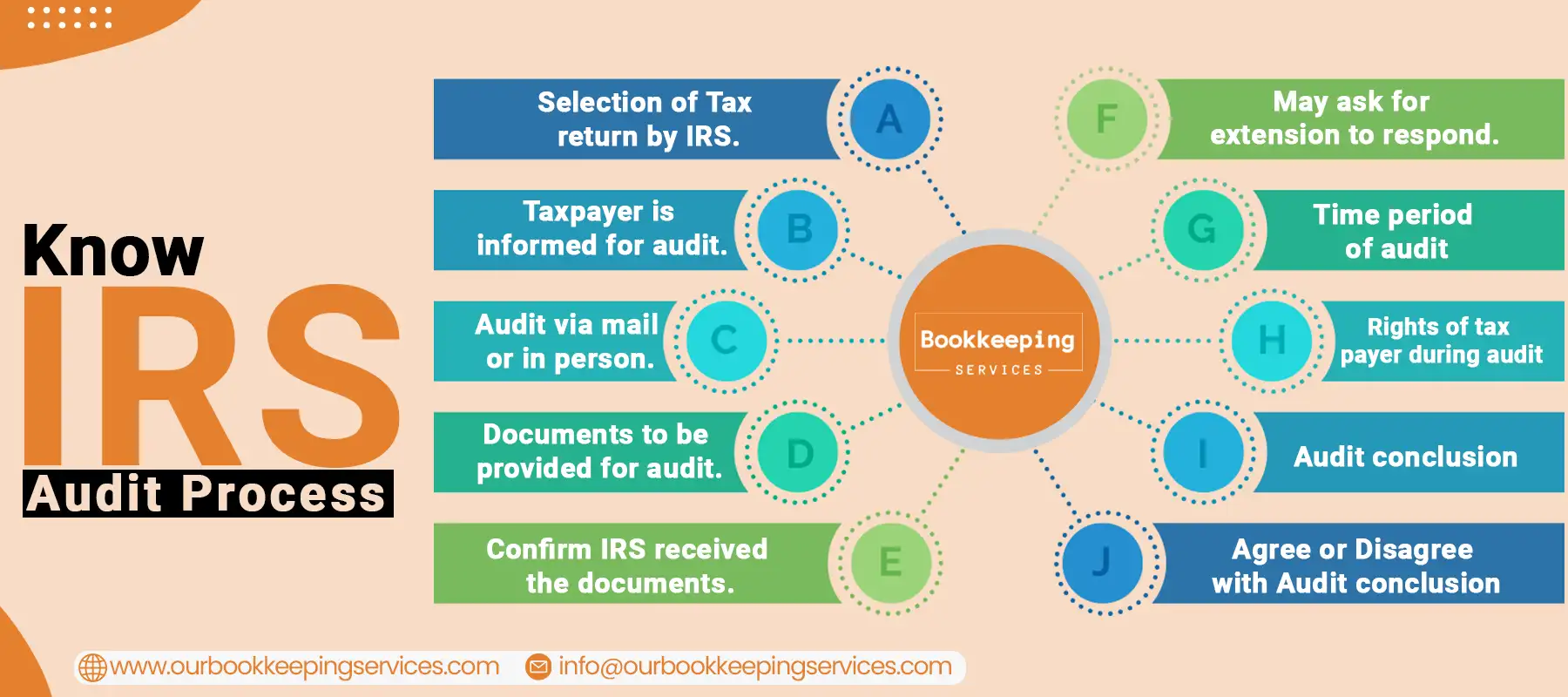

IRS Audit Process:

The Statute of Limitations and Foreign Income or Asset Audits explain how far back the IRS can go to audit you. Now we'll look at how the IRS conducts audits, such as how you're shortlisted, notified, and other procedures. We will explain this audit process in the form of FAQs:

Why has the IRS chosen to audit my tax return?

The IRS chooses your tax returns for audit based on statistical norms from previous audits and a combination of random selection and computer screening. Returns with issues or transactions with other taxpayers can also be chosen. An experienced auditor reviews your return and may accept it or identify questionable items and refer it for further investigation. Filing an amended return has no effect on the selection process; receiving a refund only occasionally leads to an audit.

How will I be informed if I am selected for an audit?

If your filed return is chosen for an audit, you will be notified by mail. The IRS does not conduct an audit over the phone.

How does the IRS conduct its audits?

The IRS manages audits via mail or in-person interviews at an IRS office or your location. Initially, you will be contacted by mail with instructions and contact information. The auditor may request additional information about the income, expenses, and deductions of the tax return. If you have an excessive number of records, you may request a face-to-face audit. Depending on the issues involved, the IRS may use Audit Techniques Guides to assist with the examination.

What documents and information do I need to provide during an audit?

The IRS will issue a written request for specific documents during an audit. Electronic records generated by tax software and other records may be requested from you. According to the law, you must keep all records used to prepare your tax returns for at least three years from the filing date. Contact your auditor to find out what types of records the IRS will accept.

How can I confirm that the IRS has received my response during an audit?

You can send the documents and information using any delivery service, but you must always request confirmation from the delivery service that the IRS received it.

Can I ask for an extension to respond to the IRS audit?

For audits conducted by mail, you can fax or mail a written request for a one-time automatic 30-day extension. If you have received a "Notice of Deficiency" by certified mail, no additional time could be granted to submit supporting documentation. For in-person audits, you can contact the auditor assigned to the audit or their manager to request an extension.

How long does the IRS audit process usually take?

The duration of an audit depends on various factors, such as the type of audit, the complexity of the issues, the availability of requested information, the scheduling of meetings, and agreement or disagreement with the findings. Therefore, the length of an audit can vary.

What rights do I have during an audit by the IRS?

You have certain rights during an IRS audit, which include receiving professional and polite treatment from IRS employees, privacy and confidentiality of your tax matters, knowing the reason for information requests and how it will be used, the option to have representation by oneself or an authorized representative, and the right to appeal any disagreements with the IRS both within the agency and before the courts.

How does the IRS conclude at the end of an audit?

There are three ways in which an audit can be concluded. The first is a "no change" audit, where all the reviewed items have been substantiated, and no alterations are required. The second is an "agreed" audit, where the IRS suggests changes, and you agree with them. The third is a "disagreed" audit, where the IRS suggests changes, but you disagree with them.

What happens if I agree with the findings of the IRS audit?

If you accept the audit results, you will be requested to sign the examination report or a similar form, depending on the audit type. In case you have tax owed, there are various payment options that you can avail of.

What happens if I disagree with the findings of the IRS audit?

In case of a disagreement with the audit results, you can ask for a meeting with an IRS manager. Additionally, you can opt for mediation services provided by the IRS or file an appeal if sufficient time is left within the statute of limitations.

Conclusion:

In conclusion, understanding the statute of limitations for IRS audits and the process for the IRS audit can help you stay compliant and avoid potential penalties or fines. If you have any questions or concerns about your tax returns, it's best to consult with a tax professional like us. We offer audit representation services if you are undergoing an IRS audit. We can review tax returns, provide guidance and support, negotiate with the IRS, and represent you in appeals if needed. The goal is to provide the necessary guidance and support to navigate the audit process and achieve the best possible outcome for you.

Previous Post